A decade ago, India’s startup landscape barely registered on the global radar. Today, it stands as the world’s third-largest startup ecosystem, home to 70K tech startups, 125 unicorns and 115 soonicorns that have redefined scale in emerging markets.

As unicorns mature and soonicorns inch closer to the billion-dollar mark, a new breed of startups is quietly rising — the minicorns. Valued between $100 Mn and $200 Mn, they form the crucial bridge between early growth and market leadership, offering a window into India’s next wave of scalable, capital-efficient innovation.

After the Unicornand Soonicorn Trackers, we present the Minicorn Tracker — mapping the next generation of disruptors shaping India’s startup landscape.

According to Inc42’s analysis, India is home to 67 minicorns, which together command a $9.3 Bn valuation and have raised nearly $3 Bn in funding since inception.

Notably, only 0.1% of all Indian startups ever cross the $100 Mn valuation mark, and among funded startups, just 1% reach this milestone. Of these, five new-age tech companies are already publicly listed. While Arisinfra, Veefin, and TAC Infosec are listed on the SME platforms, Unicommerce and Matrimony are listed on the mainboard.

Power-packed with everything from founding years and sectors to funding and investors, this tracker is your complete guide to India’s minicorn landscape.

| Name | Founded In | Type | Headquarters | Sector | Valuation | Total Funding | Stage |

Notable Investors |

| AppsForBharat | 2020 | Private | Bengaluru | Consumer Services | $175 Mn | $61 Mn+ | Late Stage |

Peak XV Partners, Elevation Capital, Z47, Mirae Asset, BEENEXT |

| Arisinfra Solutions | 2021 | Public | Delhi NCR | Real Estate Tech | $145 Mn | Not Available | Publicly Listed | Not Available |

| Atomicwork | 2022 | Private | Palo Alto/ Bengaluru | Artificial Intelligence (AI) | $100-$150 Mn | $39 Mn+ | Growth Stage |

Peak XV Partners, Khosla Ventures, Battery Ventures, Z47, Blume Ventures |

| Blue Tokai | 2013 | Private | Delhi NCR | Ecommerce | $150-$160 Mn | $130 Mn+ | Late Stage |

Verlinvest, A91 Partners, Anicut Capital, 12 Flags, Deepika Padukone |

| Bombay Shaving Company | 2015 | Private | Delhi NCR | Ecommerce | $100 Mn | $49 Mn+ | Late Stage |

Fireside Ventures, Alteria Capital, Sixth Sense Ventures, Colgate Palmolive, Gulf Islamic Investments |

| Chakr Innovation | 2016 | Private | Delhi NCR | Clean Tech | $109 Mn | $28 Mn+ | Late Stage |

IAN Group, Iron Pillar, Inflexor Ventures, SBICAP Ventures |

| CollegeDekho | 2015 | Private | Delhi NCR | Edtech | $140 Mn | $92 Mn+ | Growth Stage |

Winter Capital Partners, ETS Strategic Capital, Calega, QIC, Man Capital |

| Composio | 2023 | Private | San Francisco/Bengaluru | Artificial Intelligence (AI) | $100-$150 Mn | $31 Mn+ | Growth Stage |

Elevation Capital, Lightspeed Venture Partners, Together Fund, Operator Partners |

| Detect Technologies | 2016 | Private | Chennai | Enterprise Tech | $124 Mn | $43 Mn+ | Growth Stage |

Accel, Elevation Capital, Stride Ventures, Prosus Ventures |

| Dhruva Space | 2012 | Private | Hyderabad | Advanced Technology & Hardware | $102 Mn | $13 Mn+ | Growth Stage |

IvyCap Ventures, Silverneedle Ventures, Creative Destruction Lab, Blue Ashva Capital, IAN Angel Fund |

| Easebuzz | 2015 | Private | Pune | Fintech | $180-$190 Mn | $34 Mn+ | Growth Stage |

Bessemer Venture Partners, 8i Ventures, Varanium Capital Advisors, Guild Capital, JioGenNext |

| Easy Home Finance Limited | 2017 | Private | Mumbai | Fintech | $112 Mn | $50 Mn+ | Growth Stage |

Xponentia Capital Partners, SMBC Asia Rising Fund, Claypond Capital, FinSight Ventures, Integra Software Services |

| Enterpret | 2020 | Private | San Francisco/ Bengaluru | Artificial Intelligence (AI) | $100-$110 Mn | $25 Mn+ | Growth Stage |

Wing Venture Capital, Kleiner Perkins, Peak XV Partners, Unusual Ventures, Canaan Partners |

| Exponent Energy | 2020 | Private | Bengaluru | Clean Tech | $100 Mn | $44 Mn+ | Growth Stage |

Lightspeed Venture Partners, 3one4 Capital, Eight Roads Ventures, YourNest Venture Capital |

| FabHotels | 2014 | Private | Delhi NCR | Travel Tech | $120 Mn | $42 Mn+ | Late Stage |

Panthera Growth Partners, Goldman Sachs, Accel Partners, Qualcomm Ventures, Innoven Capital |

| Farmley | 2017 | Private | Delhi NCR | Ecommerce | $100-$110 Mn | $54 Mn+ | Late Stage |

L Catterton, Omnivore, DSG Consumer Partners, NewRadioVenture, Insitor Partners |

| FirstClub | 2024 | Private | Bengaluru | Consumer Services | $120 Mn | $31 Mn+ | Growth Stage |

Accel, RTP Global, Blume Ventures, Quiet Capital, 2am VC |

| Foxtale | 2021 | Private | Mumbai | Ecommerce | $170-$180 Mn | $67 Mn+ | Late Stage |

Z47, Kae Capital, Stride Ventures, Panthera Growth Partners, Kettleborough VC |

| Geniemode | 2021 | Private | Delhi NCR | Ecommerce | $196 Mn | $87 Mn+ | Late Stage |

Tiger Global Management, Info Edge ventures, Stride Ventures, Multiples, Fundamentum |

| Haber | 2017 | Private | Pune | Advanced Technology & Hardware | $140 Mn | $65 Mn+ | Late Stage |

Accel, Elevation Capital, Creaegis, BEENEXT, Ascent Capital |

| Hangyo Ice Creams | 2003 | Private | Mangaluru | Foodtech | $100 Mn | $30 Mn+ | Growth Stage |

Unilever Ventures, Faering Capital, Capvent |

| Indifi Technologies | 2015 | Private | Delhi NCR | Fintech | $145 Mn | $120 Mn+ | Late Stage |

Accel, Flourish Ventures, Finnfund, Elevar Equity |

| Innovist | 2018 | Private | Delhi NCR | Ecommerce | $130-$140 Mn | $29 Mn+ | Growth Stage |

Accel, Sauce VC, ICICI Venture, Amazon Smbhav Venture Fund |

| Kapiva | 2016 | Private | Bengaluru | Ecommerce | $160-$170 Mn | $111 Mn+ | Late Stage |

Patni Family Office, Edelweiss, Fireside Ventures, DSP Group, Sharrp Ventures |

| Keka | 2014 | Private | Hyderabad | Enterprise Tech | $100-$110 Mn | $58 Mn+ | Growth Stage |

WestBridge Capital, Steadview Capital, Premji Invest, Qualcomm Ventures, Endiya Partners |

| Kinetic Green | 2015 | Private | Pune | Clean Tech | $150-$170 Mn | $25 Mn+ | Growth Stage |

Greater Pacific Capital |

| Kiwi | 2022 | Private | Bengaluru | Fintech | $70-100 Mn | $43 Mn+ | Growth Stage |

Third Sphere, SquareOne Venture Capital, Deutsche Wohnen, J.F. Muller & Sohn AG |

| Kratos Gamer Network (KGeN) | 2022 | Private | Bengaluru | Media & Entertainment | $150 Mn | $42 Mn+ | Growth Stage |

Accel, Polygon, Nexus Venture Partners, Prosus Ventures, Nazara Technologies |

| LAT Aerospace | 2025 | Private | Delhi NCR | Advanced Technology & Hardware | $100 Mn+ | $20 Mn+ | Seed Stage |

Deepinder Goyal |

| Leverage Edu | 2017 | Private | Delhi NCR | Edtech | $130-$150 Mn | $73 Mn+ | Late Stage |

Venture Catalysts, Blume Ventures, Trifecta Capital Advisors, LVX Ventures, 100Unicorns |

| LiquiLoans | 2018 | Private | Mumbai | Fintech | $170 Mn | $11 Mn+ | Growth Stage |

Matrix Partners, Kunal Shah (CRED), Satya Bansal, Abhishek Dalmia, Ashutosh Taparia |

| Masters’ Union | 2020 | Private | Delhi NCR | Edtech | $90-$100 Mn | Not Available | Not Available | Not Available |

| Matrimony | 1997 | Public | Chennai | Media & Entertainment | $127 Mn | $75 Mn+ | Publicly Listed |

Mayfield Fund, Canaan Partners, Xplorer Capital, Yahoo |

| Metalbook | 2021 | Private | Delhi NCR | Ecommerce | $130-$150 Mn | $38 Mn+ | Growth Stage |

Rigel Capital, FJ Labs, Axilor Ventures, Foundamental, Stride Ventures |

| Nanonets | 2017 | Private | San Francisco/ Mumbai | Artificial Intelligence (AI) | $100-$150 Mn | $40 Mn+ | Growth Stage |

Y Combinator, Accel, Elevation Capital, Sound Ventures, FundersClub |

| Neysa | 2023 | Private | Mumbai | Artificial Intelligence (AI) | $70-100 Mn | $49 Mn+ | Growth Stage |

Nexus Venture Partners, Z47, NTT Venture Capital, Menlo Park Capital |

| Onsurity | 2020 | Private | Bengaluru | Health Tech | $109 Mn | $61 Mn+ | Growth Stage |

International Finance Corporation, Nexus Venture Partners, AngelList, Quona Capital, Creaegis |

| Paper Boat | 2009/2013 | Private | Bengaluru | Ecommerce | $180 Mn | Undisclosed | Late Stage |

Advent International, Peak XV Partners, Sequoia Capital, Hillhouse Investment, Trifecta Capital Advisors |

| Phi Commerce | 2015 | Private | Pune | Fintech | $150-$160 Mn | $25 Mn+ | Growth Stage |

BEENEXT, Blume Ventures, PayU, Razorpay, Pine Labs |

| ProcMart | 2015 | Private | Delhi NCR | Ecommerce | $103 Mn | $13 Mn+ | Growth Stage |

Fundamentum, Sixth Sense Ventures, Edelweiss Financial Services, Indiamart Intermesh, Paramark Ventures |

| QpiAI | 2019 | Private | Bengaluru | Advanced Technology & Hardware | $160 Mn | $38 Mn+ | Growth Stage |

Avataar Venture Partners, We Founder Circle, YourNest Venture Capital, National Quantum Mission |

| R For Rabbit | 2014 | Private | Ahmedabad | Ecommerce | $100 Mn | $32 Mn+ | Growth Stage |

3one4 Capital, Xponentia Capital Partners, Filter Capital, Negen Capital Services |

| Recykal | 2016 | Private | Hyderabad | Clean Tech | $100-$130 Mn | $37 Mn+ | Growth Stage |

Morgan Stanley, 360 ONE Asset, Circulate Capital, Bank of Singapore, Murugappa Group |

| Saarathi Finance | 2024 | Private | Mumbai | Fintech | $100 Mn | $58 Mn+ | Growth Stage |

TVS Capital Funds, Lok Capital, Evolvence India Fund, Paragon Partners |

| Sarvam AI | 2023 | Private | Bengaluru | Artificial Intelligence (AI) | $100-$110 Mn | $50 Mn+ | Growth Stage |

Khosla Ventures, Lightspeed Venture Partners, Peak XV Partners, NewRadioVenture |

| Scapia | 2022 | Private | Bengaluru | Fintech | $170 Mn | $72 Mn+ | Growth Stage |

Elevation Capital, Z47, Peak XV Partners, Tanglin Venture Partners, 3STATE Ventures |

| Scimplifi | 2023 | Private | Bengaluru | Enterprise Services | $130-$140 Mn | $50 Mn+ | Growth Stage |

Accel, 3one4 Capital, BEENEXT, Omnivore, Bertelsmann India Investments |

| Seekho | 2020 | Private | Delhi NCR | Media & Entertainment | $130 Mn | $37 Mn+ | Growth Stage |

Bessemer Venture Partners, Elevation Capital, Lightspeed Venture Partners, Goodwater Capital, We Founder Circle |

| SolarSquare | 2015 | Private | Mumbai | Clean Tech | $130 Mn | $60 Mn+ | Growth Stage |

Lightspeed, Lightrock, Elevation Capital, Lowercarbon Capital, Rainmatte |

| SpotDraft | 2017 | Private | New York/Bengaluru | Enterprise Tech | $132 Mn | $81 Mn+ | Growth Stage |

Arkam Ventures, Prosus Ventures, Google for Startups, 021 Capital |

| StartAgri | 2006 | Private | Mumbai | Agritech | $80-$100 Mn | Not Available | Not Available |

IDFC Private Equity |

| TAC Security | 2013 | Public | Mumbai | Enterprise Tech | $134 Mn | Not Available | Publicly Listed | Not Available |

| The Souled Store | 2013 | Private | Mumbai | Ecommerce | $160-$180 Mn | $29 Mn+ | Late Stage |

Xponentia Capital, Elevation Capital, RPSG Capital, Sara Ali Khan, Qualcomm Ventures |

| Third Wave Coffee | 2016 | Private | Bengaluru | Ecommerce | $140-$150 Mn | $62 Mn+ | Growth Stage |

Creaegis, WestBridge Capital, Elevation Capital, D2C Capital, Indus Valley Capital |

| Tonbo Imaging | 2012 | Private | Bengaluru | Advanced Technology & Hardware | $170 Mn | $45 Mn+ | Late Stage |

BlackSoil, Celesta Capital, India Exim Bank, Qualcomm Ventures, Tenacity Ventures |

| Tonetag | 2013 | Private | Bengaluru | Fintech | $180-$190 Mn | $87 Mn+ | Growth Stage |

Iron Pillar, Amazon, Mastercard, PayU, HDFC Bank |

| Traya | 2019 | Private | Mumbai | Health Tech | $120-$130 Mn | $11 Mn+ | Growth Stage |

Xponentia Opportunities Fund II, Fireside Ventures, Whiteboard Capital, Kae Capital, Beacon Trusteeship |

| TWO AI | 2021 | Private | San Francisco (Bay Area) | Artificial Intelligence (AI) | $100-$150 Mn | $20 Mn+ | Growth Stage |

Reliance Jio, Naver |

| Ultrahuman | 2019 | Private | Bengaluru | Ecommerce | $100-$110 Mn | $52 Mn+ | Growth Stage |

Nexus Venture Partners, Blume Ventures, Rainmatter Capital, Alpha Wave Incubation |

| Unicommerce | 2012 | Public | Delhi NCR | Enterprise Tech | $167 Mn | $11 Mn+ | Publicly Listed |

Nexus Venture Partners, Tiger Global Management, SoftBank Vision Fund |

| Unifyapps | 2023 | Private | New York/Delhi NCR/Hyderabad | Artificial Intelligence (AI) | $100-$150 Mn | $31 Mn+ | Growth Stage |

Elevation Capital, ICONIQ Growth |

| Veefin Solutions | 2020 | Public | Mumbai | Fintech | $102 Mn | $19 Mn+ | Publicly Listed | Not Available |

| Wellbeing Nutrition | 2019 | Private | Mumbai | Ecommerce | $100-$170 Mn | $14 Mn+ | Growth Stage |

Fireside Ventures, Klub, Hindustan Unilever, Zed Capital, ACG World |

| Wiz Freight | 2020 | Private | Chennai | Logistics | $175 Mn | $54 Mn+ | Growth Stage |

SBI Investment, Tiger Global Management, Alteria Capital, Foundamental, Stride Ventures |

| Wonderchef | 2009 | Private | Mumbai | Ecommerce | $70-100 Mn | $30 Mn+ | Late Stage |

Sixth Sense Ventures, Amicus Capital Partners, Godrej family office, Malpani Group, Capvent |

| Zluri | 2020 | Private | San Francisco/ Bengaluru | Enterprise Tech | $100 Mn | $32 Mn+ | Growth Stage |

Lightspeed Venture Partners, MassMutual Ventures, Endiya Partners, Kalaari Capital, NetApp Excellerator |

| Zolostays | 2015 | Private | Bengaluru | Travel Tech | $150 Mn | $98 Mn+ | Late Stage |

Investcorp, Nexus Venture Partners, Mirae Assets, Trifecta Capital, Alec Oxenford |

|

Source: Inc42 Analysis, Secondary Sources | ||||||||

|

Notes: For some of the companies listed, the valuations are estimated. | ||||||||

|

*Market Cap of Public Listed Companies: Last updated on 06 October 2025 |

Read our methodology here.

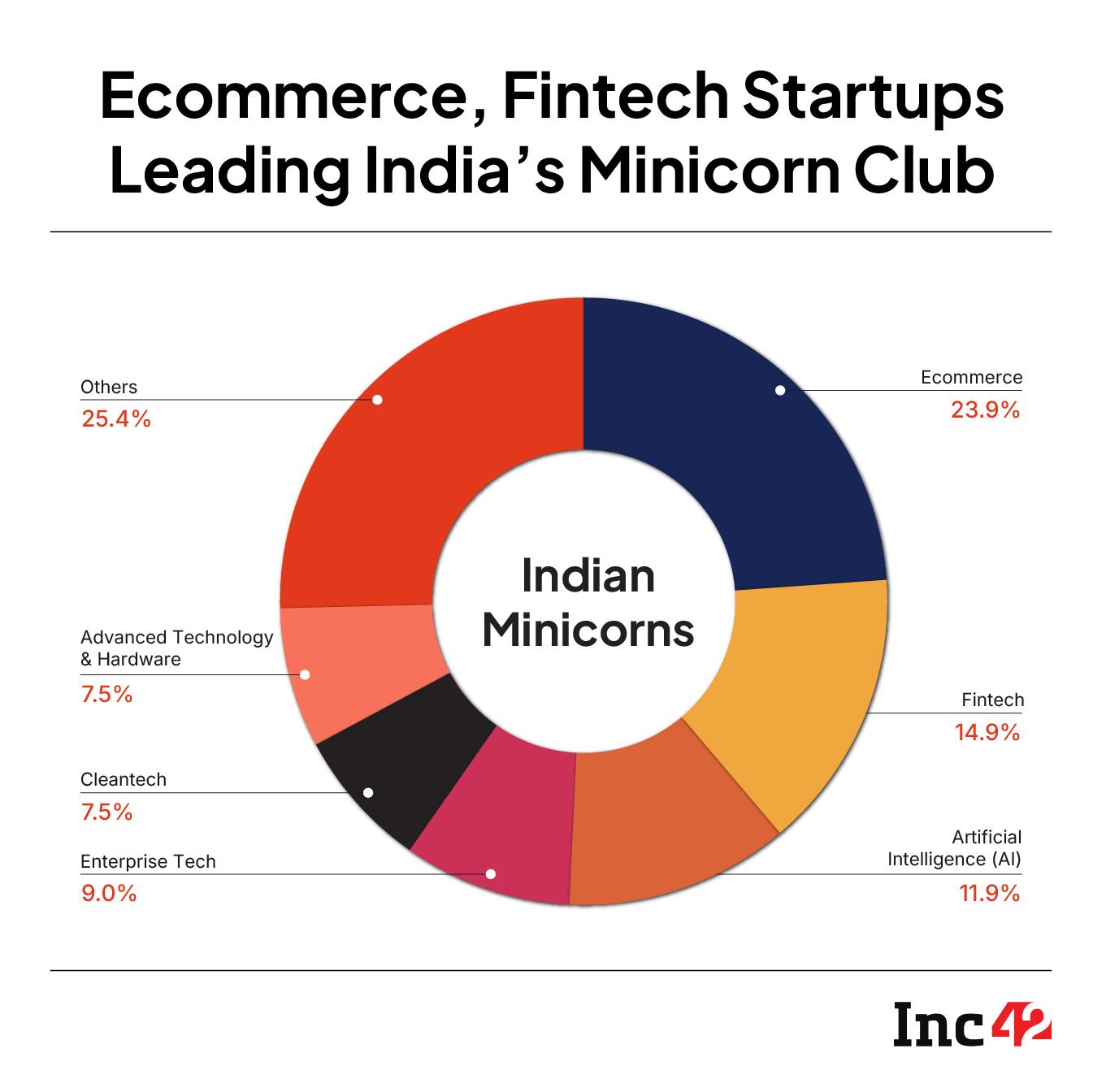

Ecommerce Leads The Indian Minicorn ClubMuch like the unicorn and soonicorn landscape, ecommerce dominates this space too. The sector, which already boasts 29 unicorns such as Meesho, Honasa and Nykaa, also nurtures 16 minicorns.

The highest-valued minicorn startups in the Indian ecommerce space are Geniemode (last valued at $196 Mn), Paper Boat (last valued at $180 Mn) and Foxtale (last valued between $170 Mn to $180 Mn).

Trailing behind ecommerce in the Indian fintech space, which is home to 10 minicorns. The fintech startup founded in 2022, Scapia, became a minicorn earlier in April when it bagged $40 Mn at a valuation of $170 Mn.

While fintech and ecommerce continue to dominate the minicorn realm, India’s AI industry is fast catching up. The sector takes the third spot in the minicorn club, housing eight startups. Names like Sarvam AI, Unifyapps, and Atomicwork, among others, sit proudly in this list.

Bengaluru Remains The Top Hub For Future UnicornsFinally, with segments like deeptech, defence tech, and spacetech, the advanced technology & hardware sector is home to five minicorns.

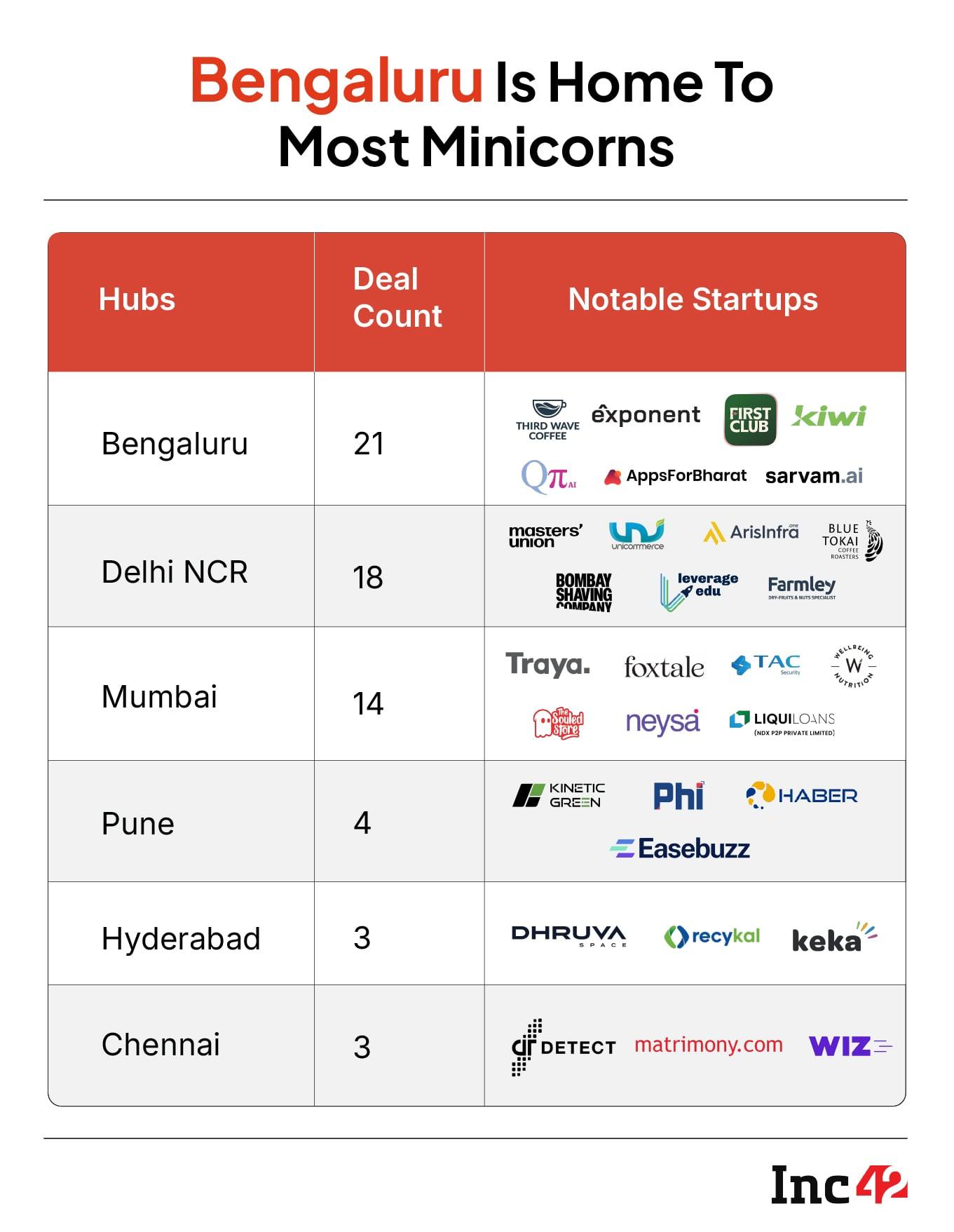

Unsurprisingly, Bengaluru leads the minicorn race. With 21 minicorns, more than a third of India’s total are headquartered in the Karnataka capital. Some prominent names include AppsForBharat, FirstClub, Kiwi, and QpiAI.

Delhi NCR and Mumbai trail just behind Bengaluru at 18 minicorns. Mumbai currently houses 14 minicorn startups.

The next wave of minicorns is also hailing from cities like Pune, Hyderabad and Chennai. While ecommerce startup Easebuzz is based in Pune, Keka calls Hyderabad its home. Listed minicorn Matrimoney is headquartered in Chennai.

With this, let’s dive into the world of minicorns, startups set to power the next phase of growth for India’s startup economy.

Indian Minicorn Tracker will be updated periodically with fresh data, funding rounds, and exits. Stay tuned.

[Edited by: Shishir Parasher]

The post India Minicorn Tracker: Mapping The Next Wave Of High-Growth Startups appeared first on Inc42 Media.

You may also like

People are just realising what happens to their food when they use an air fryer

Mum 'left in tears' after stranger 'exploded' at her child over accident

Robbie Williams in sweary Taylor Swift rant as he performs in 600-capacity venue

Exercise KONKAN-25: Sea phase concludes with high operational tempo, seamless interoperability

Football-mad Wrexham fan scoops £3M Omaze mansion